Introduction

College life is very fun. Trust me, I have had my fair share of it. But on the flip side, it can be financially stressful, especially to ones who do not know how to manage their money. Between tuition, books, food expenses, and experiences outside of school, money can seem to fly away. There is good news from this, though. Through a practical budgeting strategy, you can maximize your money for the duration of your college career and build good habits to set you up for the rest of your life.

The first thing you want to do is figure out a time period for your budget. This can be weekly, monthly, or yearly but, the easiest period is monthly.

Know Your Income/Expenses

Since this blog serves as a starting point for some, I will go over the fundamentals of finance as we move. Income is the money that you have coming in. In college, this can come from work-study, part-time job, internships, financial aid refunds, or side hustles. Sounds fairly simple, right? Your expenses are the money that you know you have to spend within a given period or, money coming out of your pocket. This can be tuition payments, subscriptions to streaming services, groceries, transportation, personal maintenance, and entertainment.

You want to know these figures beforehand and plan accordingly for the best results. The key is to actually PLAN AHEAD for what you think you might earn and spend money on.

Tip : Use budgeting apps like Mint or YNAB to get started. You can also use pen and paper if you feel like it is easier to write down and visualize.

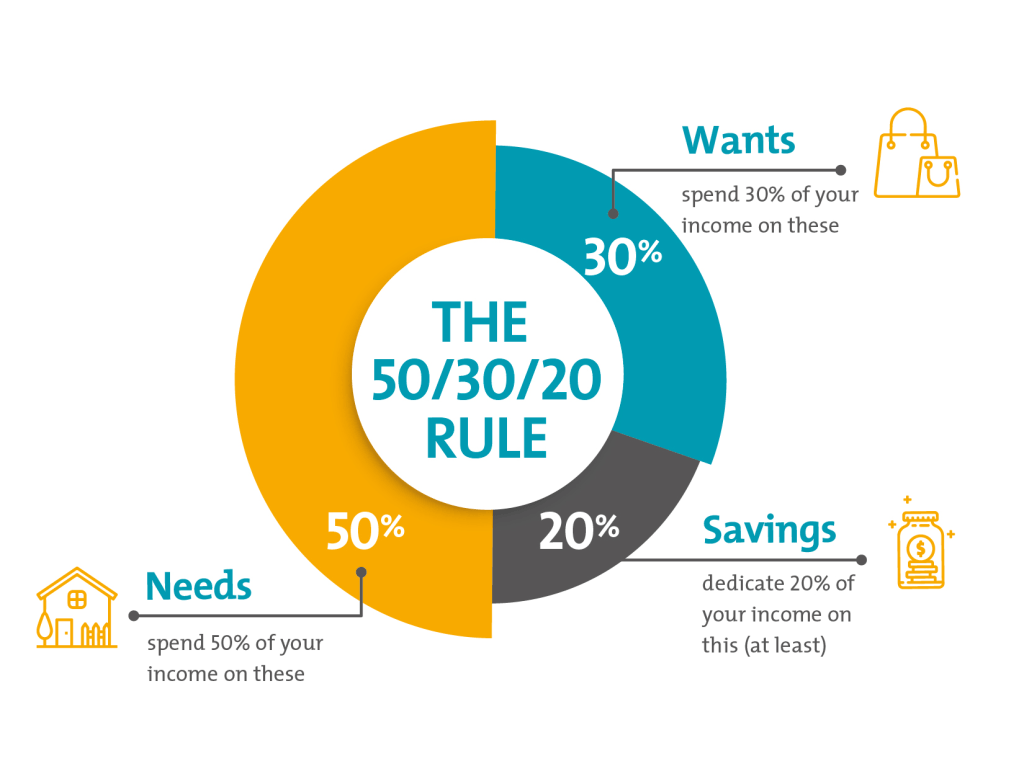

Apply 50/30/20 Rule (Student Spin-off)

The 50/30/20 rule is a budgeting principle that states that 50% of your income should go towards your needs, 30% goes towards your wants, and 20% goes towards your savings. Your needs are the expenses like groceries, transportation, phone bill, and tuition payment. Things like subscriptions, entertainment, and maintenance are categorized as wants. Your savings is a tool that helps you grow your money over time and set your future up for success. Without a savings account, emergency fund, or money in stocks (lesson coming soon), money can disappear fast and you will not have the money to take care of emergencies like a medical bill or a flat tire.

There is a saying in finance that says “A dollar with no place isn’t a dollar at all.” What this means is that you should always have a plan for every dollar that you have so you don’t go around spending money recklessly.

Now, I know for college students, the income may not be as much as you would like. Taking this into account, there is another principle called the 70/20/10 rule, which has the same order, just different numbers. This allows students to prioritize their needs while still having just enough to have fun and take care of their future selves.

Ways to Cut Costs

Luckily, there a number of efficient ways to cut expenses while in school. First, rent textbooks or buy them used. I know it is not ideal, but you would be surprised at how good the condition is for a relatively cheaper price. Second, take advantage of student discounts at participating stores. Next, meal prep instead of eating out. This prepares you for life after college and saves you money on restaurant expenses that add up over time. Lastly, use free campus events for entertainment. It is a great way to bond and make new friends while not spending a dime.

More Tips

- Review your budget and maintain it as much as possible.

- Set up a high-yield savings account. (See next post)

- Open a Roth IRA. (See next post)

- Printable Budget Template

Budgeting in college is not meant to restrict you. It is a guide to help you build better habits and have control over your money and life. By tracking your money, you can make better financial decisions and get set up for long-term success.

Thank you for reading! Feel free to share your own budgeting tips or experiences in the comments. Subscribe for more content and ride the wealth wave!

Leave a comment